Capital Protection First: The Risk Management Framework That Preserves Wealth in Any Market

Introduction: Why Risk Management Is the Real Profit Center

Most traders focus on the wrong thing. They obsess over entry points, chase the highest-conviction setups, and dream of the perfect trade that will double their account. Yet, the traders who consistently outperform are those who focus obsessively on what they can lose, not what they can gain.

This is the fundamental principle behind MarketModel's risk management framework: Capital protection first, growth second. It sounds counterintuitive, but the mathematics are undeniable. A trader who loses 50% of their capital must gain 100% just to break even. A trader who limits drawdowns to 10% only needs to gain 11% to recover. Over decades, this compounding difference is the difference between wealth and ruin.

In this article, we'll explore the risk management framework that has enabled MarketModel to deliver consistent outperformance while protecting subscribers' capital through multiple market cycles. We'll examine the three key components of this framework: position sizing, dynamic scaling, and drawdown management. By the end, you'll understand why risk management is not a constraint on returns—it's the foundation of them.

The Mathematics of Drawdowns

Before diving into the framework, let's establish the mathematical reality of drawdowns. This is not theory; it's arithmetic.

Imagine two traders, both starting with $100,000:

Trader A (No Risk Management): Experiences a 50% drawdown (down to $50,000), then gains 100% (up to $100,000). Total time: 2 years. Total return: 0%.

Trader B (Risk Management): Experiences a 10% drawdown (down to $90,000), then gains 11% (up to $100,000). Total time: 2 years. Total return: 0%.

Both traders end up at the same place, but Trader B suffered far less emotional stress and had far more capital available to deploy during the market correction. Over a 20-year period, this difference compounds dramatically.

Consider a more realistic scenario over 10 years:

Trader A (No Risk Management): Achieves 15% annualized returns but experiences three 40% drawdowns. After 10 years: $405,892.

Trader B (Risk Management): Achieves 12% annualized returns but experiences only 8% average drawdowns. After 10 years: $310,585.

Wait—Trader A has more money. But here's the catch: Trader A also has a 40% chance of being wiped out during a market crash. Trader B sleeps at night and has the flexibility to deploy capital when opportunities arise.

The real advantage of risk management is not higher returns—it's sustainable returns with lower volatility and lower risk of ruin. This is the foundation of wealth building.

Component 1: High-Conviction Position Sizing

The first component of MarketModel's risk management framework is high-conviction position sizing. This is not about taking every setup that comes along or spreading capital across multiple mediocre trades. It's about waiting for the highest-probability setups and sizing accordingly when all three macro pillars align.

MarketModel's philosophy is simple: we only take high-conviction trades. This means we are not wasting mental capital, emotional energy, or portfolio bandwidth on low-conviction setups at 20% or 30% exposure. When economic momentum, liquidity conditions, and sentiment extremes all align to create a compelling setup, we act decisively.

Here's how the MarketModel scaling approach works in practice:

High Conviction Setup (All Three Pillars Aligned):

•Economic momentum is clearly deteriorating (or improving, depending on directional bias).

•Liquidity conditions are tightening (or expanding) significantly.

•Sentiment is at extremes, signaling a contrarian opportunity.

•Your macro framework gives you an 80%+ probability of a directional move.

Position Sizing with Leverage:

•Initial Position: 80% of capital.

•First Scale-In: 110% of capital (using modest leverage).

•Second Scale-In: 140% of capital (using leverage to maximize the high-probability setup).

Rationale: When all three pillars are aligned, the probability of success is significantly higher than a typical trade. By using leverage on these high-conviction setups, we can maximize returns while still maintaining strict risk management through position-level stops and portfolio-level drawdown limits. This approach allows us to concentrate capital and mental energy on the trades that matter most, rather than diluting focus across multiple low-conviction positions.

The key insight is that not all trades are created equal. Most traders make the mistake of treating every setup the same, sizing positions uniformly regardless of conviction level. MarketModel does the opposite: we wait for the highest-probability setups and size aggressively when the macro framework confirms our thesis. This disciplined patience, combined with decisive action when opportunities arise, is what separates consistent outperformance from mediocrity.

Component 2: Dynamic Scaling In and Out

The second component is dynamic scaling—the practice of building and reducing positions gradually rather than going all-in or all-out on a single decision.

Dynamic scaling serves two critical functions:

First, it reduces the risk of being wrong on entry. Instead of betting your entire position on a single price level, you scale in gradually as confirmation develops. If the market moves against you, you've only risked a small portion of your capital. If it moves in your favor, you have the opportunity to add to the position.

Second, it allows you to manage risk dynamically as market conditions change. If you're halfway into a position and the macro setup deteriorates, you can stop scaling in and reduce exposure. If the setup improves, you can continue scaling in. This flexibility is invaluable in a dynamic market environment.

A typical MarketModel scaling approach might look like this:

Initial Position (80% exposure): Market conditions are setting up. The model takes an initial position.

First Scale-In (110% exposure): Economic data comes in line with macro, confirmation develops. Market enters support levels, you add to the position.

Second Scale-In (140% exposure): The setup is fully confirmed. All macro pillars are aligned. You increase to near-full exposure at defined support levels

Scale-Out (80% exposure): The market has rallied significantly. You begin reducing exposure into strength, locking in gains and reducing risk.

Final Scale-Out (0% exposure): Your macro thesis has played out. You exit completely and wait for the next setup.

This approach is far superior to the binary "all-in or all-out" approach used by most traders, because it allows you to adapt to changing market conditions and reduce the impact of being wrong on timing.

Component 3: Drawdown Management

The third component is drawdown management—the practice of actively monitoring and limiting the maximum loss you're willing to accept.

Drawdown management operates at two levels:

Position-Level Stops: Each individual position has a predefined stop loss. If the market moves against you by a certain percentage, you exit the position automatically. This prevents a single bad trade from becoming a catastrophic loss.

Portfolio-Level Exposure: Beyond individual position stops, you also monitor your overall portfolio exposure. If your portfolio is down 5% from recent highs, you might reduce overall exposure by 25%. If it's down 10%, you might reduce exposure by 50%. This prevents a series of losing trades from compounding into a major drawdown.

The key is that these stops are predefined before you enter the trade. You don't decide whether to cut losses when you're in pain; you've already decided in advance. This removes emotion from the equation.

Real-World Example: The 2022 Correction

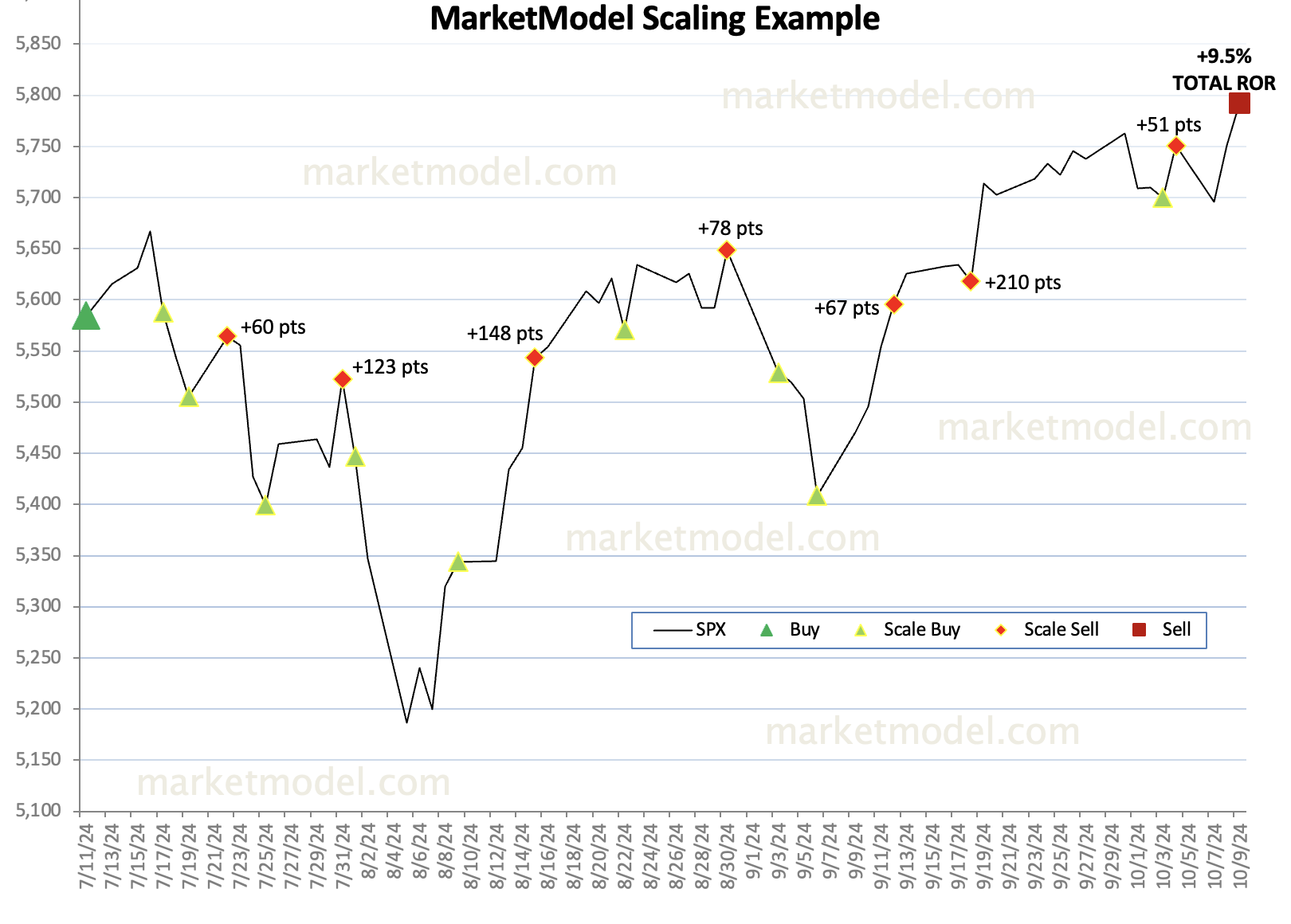

Let's examine how this framework worked during the 2024 market. As you can see from the image below where MarketModel scaled into positions when Macro aligned allowing minimal drawdowns while extracting a large profit. Compare this to a buy-and-hold investor who suffered the full drawdown and had no dry powder to deploy.

The Psychological Edge

Beyond the mathematical advantage, risk management provides a psychological edge. When you know that your maximum loss is limited, you can think clearly. You're not in panic mode. You're not making desperate decisions. You're executing a plan.

This psychological clarity is invaluable in volatile markets. While other traders are frozen in fear or making impulsive decisions, you're calmly executing your risk management framework. This composure often translates into better decision-making and better results.

Conclusion: Risk Management as Profit Center

The conventional wisdom is that risk management limits returns. The truth is the opposite. Risk management is the foundation of sustainable, long-term wealth building. By matching position size to conviction, scaling in and out dynamically, and managing drawdowns actively, you can achieve superior risk-adjusted returns while sleeping at night.

The traders who consistently outperform are not those who take the biggest risks or make the boldest calls. They are those who manage risk obsessively and let the market reward them for their discipline. This is the MarketModel philosophy, and it's the framework we use to deliver consistent outperformance for our subscribers.